April 2017 | view this story as a .pdf

Buying a home can be a defining step towards independence. But with Portland’s popularity pushing house prices sky high, how do first-time buyers turn dreams into bricks and mortar?

By Olivia Gunn

Everyone makes big moves in the spring. U-Haul trucks block side streets on Munjoy Hill. “FREE” signs are taped to forlorn futon frames left curbside. Facebook posts promise ‘a clean, responsible roommate who works mostly nights.’ In the four years we’ve lived in Portland, my fiancé and I have moved twice. Our frantic search usually ends in less space for more rent. Each time, our parents ask, “Have you talked about buying?” Well, if you mean pointing out dream houses while headed to Higgins Beach or coveting cabins on Instagram, then, yeah, we’ve thought about buying.

Everyone makes big moves in the spring. U-Haul trucks block side streets on Munjoy Hill. “FREE” signs are taped to forlorn futon frames left curbside. Facebook posts promise ‘a clean, responsible roommate who works mostly nights.’ In the four years we’ve lived in Portland, my fiancé and I have moved twice. Our frantic search usually ends in less space for more rent. Each time, our parents ask, “Have you talked about buying?” Well, if you mean pointing out dream houses while headed to Higgins Beach or coveting cabins on Instagram, then, yeah, we’ve thought about buying.

“I have two daughters, both in their late twenties,” says Bruce Ocko, 56, Senior Vice President of Mortgage Lending at Bangor Savings Bank. “When I was their age, the biggest goal was to own my own house. That was the first step into adulthood. That’s not necessarily the driving factor for younger generations. They’re more concerned with cultural and societal issues and being in an area that’s culturally thriving. It’s less important for them to have the white picket fence.”

On top of this, many of Generation Y, myself included–I’m 27–are still trying to figure out the next steps of our five-year plans. Budgeting for next month’s rent is enough of a challenge. But as Maine already has the oldest residents of any state in the country, Ocko believes it’s important that the ‘youth’ know there are options for buying a home should we consider settling down here. Because, for all the cultural camouflage, there really still is an inside track.

Dollars & Sense

Since the formation of MaineHousing in 1969, the program has offered a First Home Loan for “individuals and families who cannot afford decent, safe, sanitary housing without financial assistance.” For first-time homebuyers in Portland and surrounding areas, there’s an income limit of $76,800 for a household of one to two members and a limit of $88,320 for three or more. Combined with a Federal Housing Authority Loan and private mortgage insurance through United Guaranty, a homebuyer could potentially get a first mortgage with no down payment after meeting the criteria.

Daring to take on a mortgage is the first step, according to Debbie King-Johnson, Consumer Education and Outreach Officer at MaineHousing. “Some lenders will qualify you,” but beyond that, in the comfort of your own financial privacy, “you need to do your own housing budget.” That is, even if someone else qualifies you, you need to square it with yourself.

The First Home Loan combined with a Federal Housing Authority Loan or a Rural Development Loan is a great trifecta for first-home buyers to consider in Maine. To qualify for a $3,500 bonus towards a down payment, prospective first-time buyers will have to take a homebuyer education course online through MaineHousing’s website or at hoMEworks, a Maine non-profit established in 1998 that offers homebuyer/owner education.

Taking the Plunge

Paige Button and fiancé Jeff Hochmuth, both 26, confess that missing out on a crash course in home buying “is one of our biggest regrets. Being able to understand the market and the process really changes the way you approach the entire thing and the level of stress involved,” The couple just closed on a first home in Waterboro after renting in Maine for several years.

This first purchase was prompted when their most recent lease came to an end and the landlord decided to sell the property. What to do? “We were used to paying around $1,300 a month for a two bedroom rental in Lyman,” says Button, a vet technician. But try and find that at the exact moment you, your fiancé, and two Siberian huskies need it. “Finding places to rent that were geographically suitable was a challenge, so we did a little research and concluded that the market is only supposed to become harder for buyers in the future. It seemed like the ideal time to jump in with both feet.”

Home Buying 101

If you’re getting the urge to take the plunge and start hunting for homes online, be prepared. You’re likely not going to see many single-family homes under $300K in the Portland area. “The market has a lot to do with affordability,” King-Johnson says. “The Portland market has property prices increasing at a rapid rate. There are multiple buyers, bidding wars, and people making offers on homes greater than the asking price. You have every reason to be nervous because it feels like what we saw happening before the housing crisis.”

In realistic terms, you may want to look beyond Portland’s pricey neighborhoods. Gena and Matt Lamontagne, of the The Matt and Gena Team of The Maine Real Estate Network, say buyers are sometimes astonished to learn that areas as close to Portland as Westbrook, Gorham, and Windham are all eligible for the USDA’s Rural Development Single Family Housing Loan Program. “They’re also the most popular areas I’m seeing for first-time home buyers,” Gena says. The couple offers regular Home Buying 101 events in order to warm the waters for prospective first-time buyers who “just don’t know where to start.”

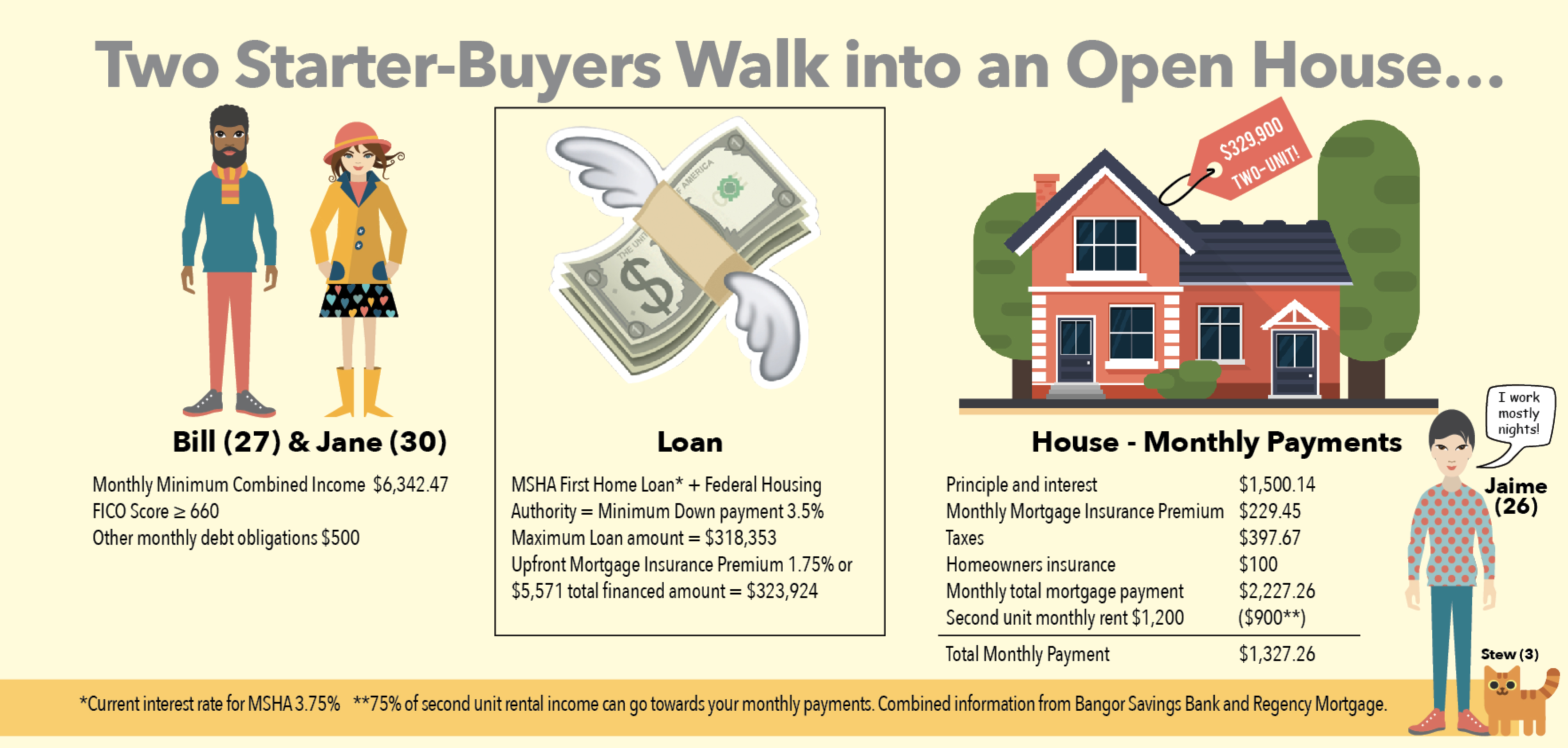

If you’re set on buying in Portland, don’t count yourself out. Why not consider investing in a multi-unit property? Yes, that means you’d be a landlord, but it also means you’d have a paying lodger. A two-unit property at 204 Auburn Street in Portland is listed on Zillow for $329,900. Seeing as this price falls below the Maine Housing Authority’s two-unit listing price maximum, I got in touch with Debra Abbondanza at Bangor Savings Bank for advice. Assuming a combined income of $76,109 (below the MHA’s First Home Buyer Loan limit of $76,300 for a two-person household), Abbonanza explains how a first-time home buyer can go about purchasing this property. See the graphic below.

She made it look easy, didn’t she? So why aren’t more of us investing in multi-unit properties? The answer might be as simple as a lack of financial education. Katie Brunelle, co-founder of the Adulting School in Portland, tells us, “One of the most requested courses is simply money management. Millennials don’t even know where to begin. We start off with budgeting and move onto advice on how to pay off debt (credit cards and student loans) while still saving money.”

John Hatcher of The Hatcher Group of Keller Williams Realty laments the lack of financial guidance available to young people. “In this country, we don’t teach people these skills. It’s not engrained into us. When did you learn to balance a checkbook?” No comment. “Young people simply aren’t taught how to grow personal wealth.”

According to the Washington Post,

homeownership rates among those of us under 35 are at an all time low–a mere 34.1%, half the national average. While baby boomers are anxious to offer their theories on so-called ‘lazy, entitled millennials,’ the figure has more to do with the aftermath of boomer home buying habits through the early 2000s and eye-watering student debts than a lack of ambition or “buying too much avocado toast” as Australian columnist Bernard Salt recently claimed.

Feeling overwhelmed myself, though at least vaguely intrigued, I ask Gena to walk me through a typical 101 class over coffee. “People think you can’t talk to anyone before you’re ready, but the ideal time to start planning is a year or two before you’re ready to buy. The first step is pre-approval, a 20-minute process that tells you what you can afford. Once you have that number, you can break it down into a monthly budget. Many young buyers may be concerned that student debts affect their loan approvals, but you’ll find many lenders are willing to work with you to get around this issue.

After all this, you’ll likely be left asking, “When is a good time to buy?” According to Gena, the time is now. “Interest rates are low, and prices are staying steady. No one can predict if there will be another housing crisis.” On the other hand,“lenders are being more strict, which is good for buyers’ protection.”

While I’m still trying to convince my fiancé to get pre-approved, Button and Hochmuth are in the final stages of buying their first home–and they couldn’t be more excited. After getting outbid on a place earlier this year, the two weren’t about to let it happen again when they found a gambrel-style house that was just right. To ensure they’d come out first in the bidding war, “We had to think outside of the box,” says Button. “We wrote a very sincere letter to the sellers with photos (including the huskies) and links to videos to show them how we’d appreciate the home they’d spent 15 years in. That letter made all the difference.”

The couple moved in at the end of March. “No one thought we stood a chance at ending up with this house! Even if they’d declined our offer, we could walk away knowing we dared to try everything.”

0 Comments